FEATURES

All financial tools. One connected platform.

Banqeta brings together multi-currency accounts, digital wallets, global Visa virtual cards and Banqit near instant settlement in one place. Traditional rails and digital networks work side by side, giving your business faster payments, lower costs and seamless access to new markets.

Multi-Currency Accounts

Operate in global markets with local accounts

Managing global payments through traditional banks is slow, expensive, and fragmented. Opening accounts in different regions often means multiple providers, endless paperwork, and high fees. Banqeta solves this by giving businesses direct access to named accounts in major currencies, all managed from a single platform.

Key markets including the US, UK, EU and UAE connect directly to domestic payment rails for faster local settlement, while every supported currency comes with dedicated account details and full SWIFT reach for international flows. This lets you collect payments locally, pay suppliers abroad, and manage global operations with far less complexity, cost, and delay.

Supported Currencies

USD, EUR, GBP and AED

Additional currencies can be added where business demand justifies it.

Local Payment Rail Connectivity

US Dollar (USD) – ACH and FedWire

Euro (EUR) – SEPA and SEPA Instant

British Pound (GBP) – Faster Payments, CHAPS and BACS

UAE Dirham (AED) – UAEFTS

SWIFT Access for All Currencies

Every account is enabled with SWIFT, giving you global coverage even where local rails are not available.

Transparent FX

All tiers enjoy competitive spreads, with preferential rates available on higher tiers.

Global Eligibility

Available to eligible businesses in 130+ countries.

Digital Wallets

Bring digital currencies into your daily business

For modern businesses, digital currencies are no longer optional. But managing them securely, transparently and alongside traditional accounts has always been a challenge. Banqeta integrates digital wallets directly into your business account, so you can hold, move and convert digital value in the same place as your traditional currency balances. Whether you’re accepting payments in stablecoins, holding Bitcoin as part of your treasury, or paying suppliers with USDT, Banqeta makes it simple and safe. Our wallets are designed for business, with institutional grade security, multi-chain support and the flexibility to use digital assets as part of everyday operations.

Supported Digital Currencies

Stablecoins

USD Coin (USDC) available on Ethereum, Polygon (Native) and Solana

Tether (USDT) available on Ethereum, Polygon (Bridged), Tron and Solana

Euro Coin (EURC) available on Ethereum

Dai (DAI) available on Ethereum

Other Digital Currencies

Bitcoin (BTC) on Bitcoin

Ethereum (ETH) on Ethereum

Polygon (MATIC) on Polygon

Solana (SOL) on Solana

Tron (TRX) on Tron

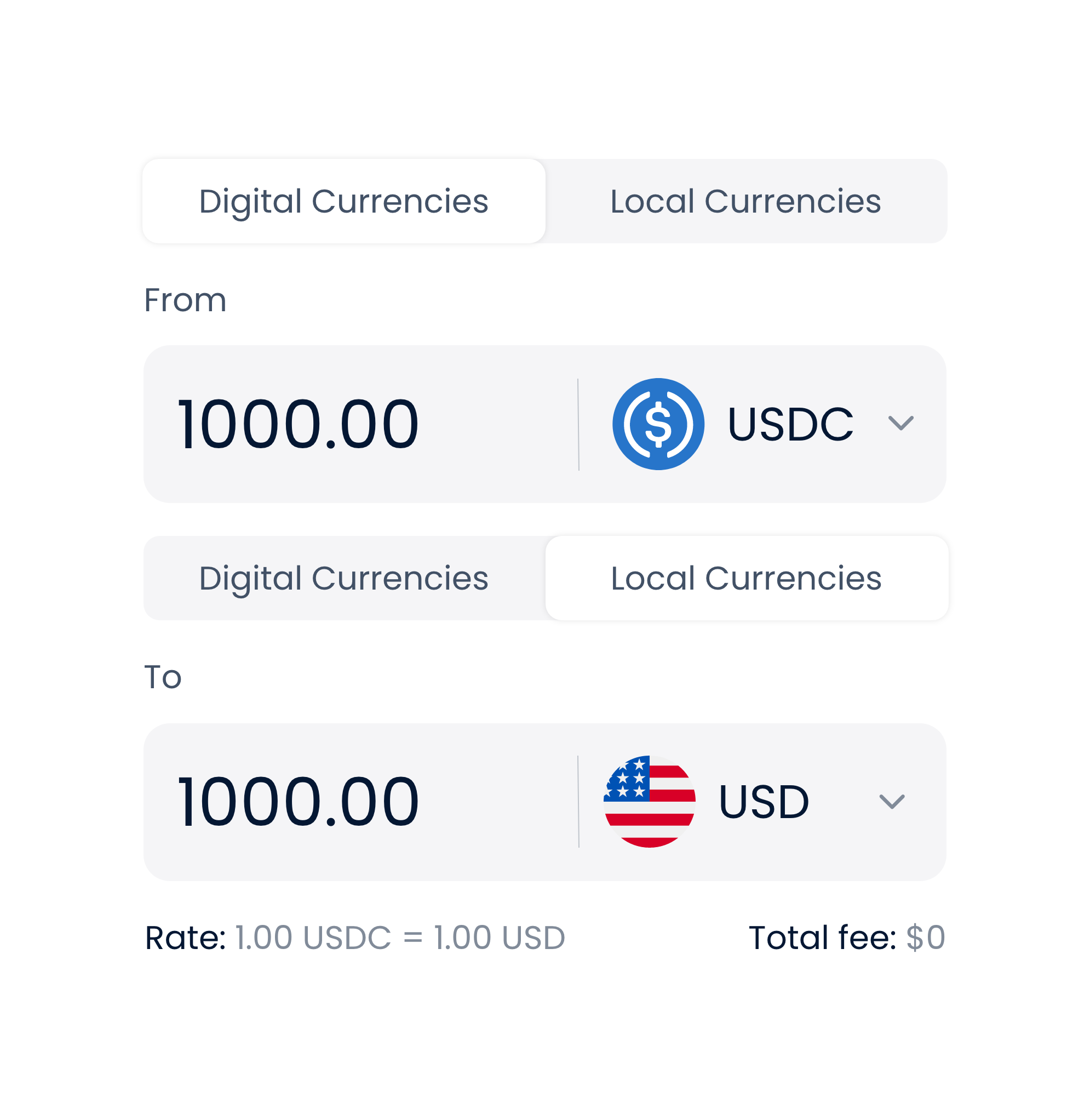

On/Off Ramp Support

Full support across Ethereum, Polygon, Solana and Tron.

Zero Banqeta Fees

No Banqeta fees to send or receive digital currency, network fees only.

Security First

Enterprise grade encryption, multi-factor authentication and 24/7 monitoring.

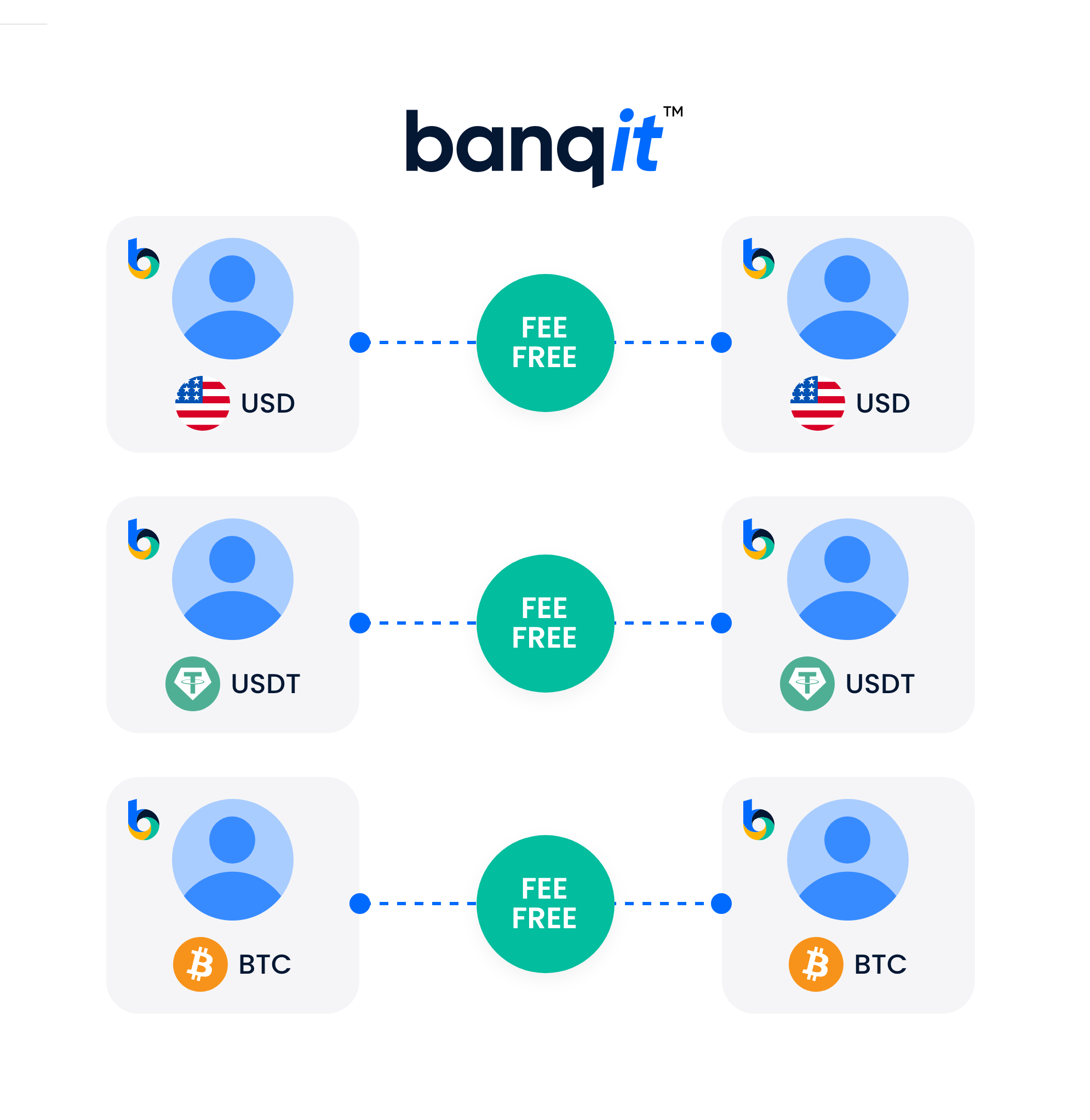

banqit™ Network

Instant settlement between Banqeta businesses

Settlement has always been the slowest, most expensive part of business. Bank wires take days, refunds are delayed, and cross-border payments with other providers carry heavy fees. banqit™ fixes this with a dedicated near instant settlement network within Banqeta. Any two businesses on the platform can send or receive payments in minutes when using the same currency. Transfers are almost instant, fee free, and without limits. Paying suppliers, refunding customers, or managing treasury balances becomes as simple as moving money between your own accounts. For global companies, Banqit™ is the smarter alternative to outdated rails, delivering instant, borderless settlement when accounts align in currency.

Near instant, Fee Free Transfers

All transfers settle almost instantly in the same currency, with no Banqeta fees.

All Supported Currencies

Available across all traditional and digital currencies supported by Banqeta.

Business-to-Business Connectivity

Banqeta users can pay or be paid by another instantly in the same currency.

Treasury Management

Reallocate liquidity across entities, subsidiaries or departments in real time.

Availability

Live worldwide for all Plus and Elite tier users.

Virtual Visa Cards

Issue company cards instantly, spend globally

Waiting weeks for physical cards slows businesses down. Banqeta Virtual Visa cards are issued instantly, ready to spend online and available in USD, GBP and EUR. Perfect for global teams, contractors and project-based spending, they provide immediate access to company funds while giving you complete visibility and control. Real-time alerts, configurable limits and instant freeze or cancel options mean you can empower staff without losing oversight. With worldwide acceptance and enterprise-grade security, Banqeta virtual cards are a faster, smarter way to manage business spending.

Global Acceptance

Accepted at 100M+ merchants worldwide wherever Visa is recognised.

3 available virtual card currencies

Banqeta virtual Visa cards are available in USD, GBP and EUR.

Real-Time Control

Track spend, set rules and limits, freeze or cancel instantly.

Built for Global Teams

Issue cards instantly to staff or contractors worldwide.

Enhanced Security

Unique card details and rapid re-issuance reduce fraud risk.

On/Off Ramps

Seamlessly move money in and out of Banqeta

Every business needs a simple way to move money in and out of the platform. Banqeta’s on/off ramps make this seamless by connecting directly with both traditional banking networks and leading digital currency blockchains. You can fund your Banqeta account from your bank, withdraw revenue back to your bank or digital wallet, or shift balances instantly between your own Banqeta accounts and wallets. This gives you full flexibility to manage liquidity on your terms, without delays or hidden fees. Whether you’re topping up working capital, cashing out digital currency earnings, or reallocating funds across different markets, Banqeta provides a transparent and efficient bridge between the traditional financial system and the digital economy.

Supported Rails and Networks

US Dollar (USD) – ACH and FedWire

Euro (EUR) – SEPA

British Pound (GBP) – Faster Payments, CHAPS and BACS

UAE Dirham (AED) – UAEFTS

SWIFT (all supported currencies)

Ethereum

Polygon

Solana

Tron

BTC

Frictionless Deposits and Withdrawals

Easily add funds from your own bank, withdraw back to your bank or external wallet, and move money instantly between your Banqeta accounts and wallets.

No Hidden Fees

Transparent pricing with no markups buried in conversions.

Inside and Outside the Ecosystem

Use BanqIT for instant transfers between Banqeta users in the same currency, and On/Off Ramps when you need to move money to or from external banks or wallets.

Global Access

Available to businesses in 130+ countries.

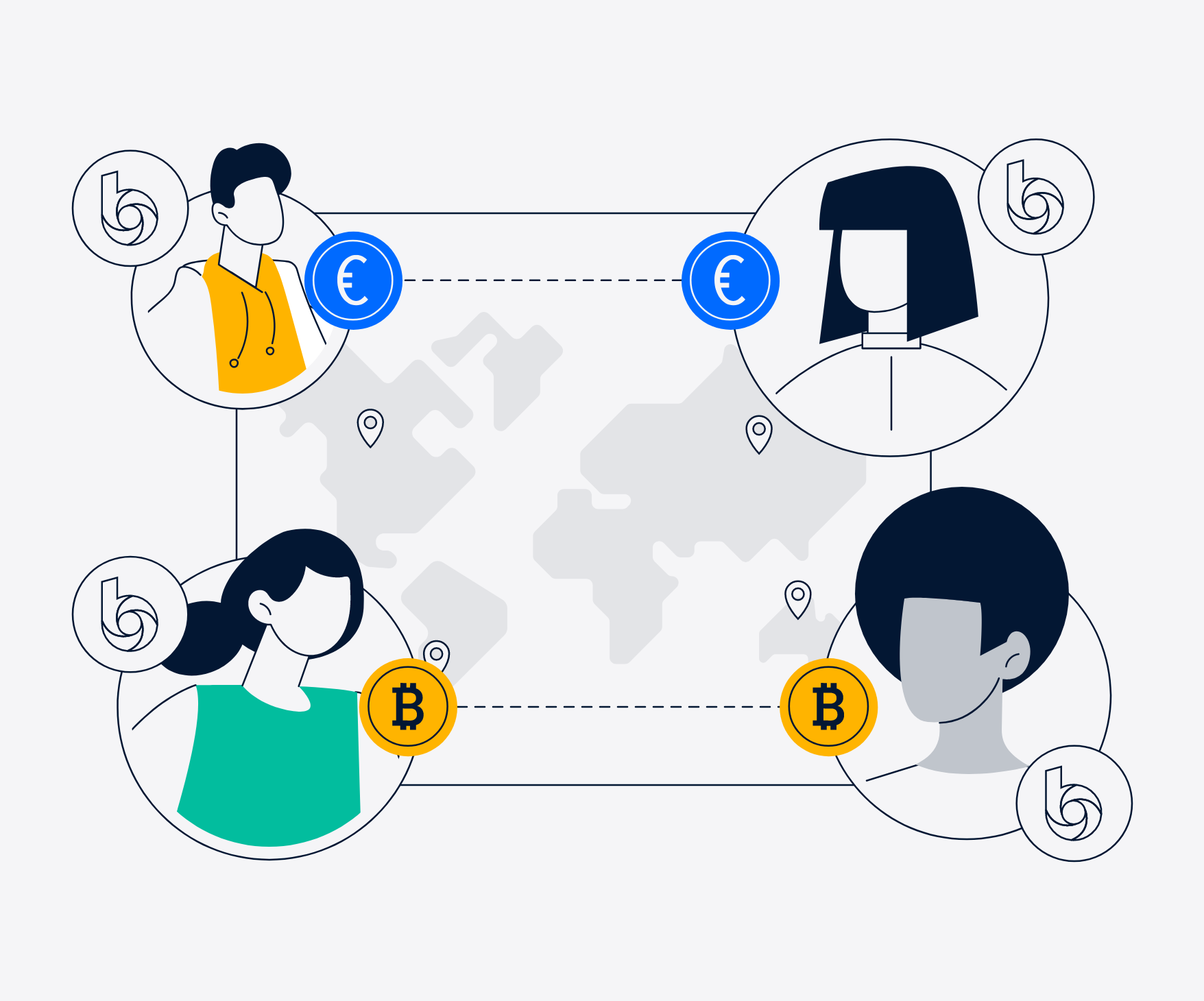

FX & Global Transfers

Flexible, low-cost international payments

Traditional cross-border payments are slow, unpredictable and costly. Banqeta gives businesses a better way, combining competitive FX pricing with flexible settlement options so you choose how each transfer is made. Use local payment rails for faster settlement, blockchain networks for instant transfers of digital assets, or SWIFT for traditional flows. With transparent, tier-based spreads based on your account level and coverage across more than 180 countries, Banqeta puts you in control of international payments, helping you pay suppliers, repatriate revenue and balance treasury flows at scale.

Choice of Payment Route

Domestic payment rails: ACH and FedWire (USD), SEPA and SEPA Instant (EUR), Faster Payments, CHAPS and BACS (GBP) and UAEFTS (AED)

Blockchain networks: Ethereum, Polygon, Solana, Tron and BTC

SWIFT available for all supported currencies for traditional cross-border transfers

Transparent FX

All tiers enjoy competitive spreads, with preferential rates available on higher tiers.

Global Reach

Send payments to over 130 countries.

No Hidden Fees

Clear, upfront pricing with no intermediaries or surprise costs.

Integrated with Banqeta

Works seamlessly with your Banqeta accounts, wallets and Banqit™.